How to check if a business is VAT registered

Is it possible to check if a company is VAT registered?

In a word, yes, but like many things relating to VAT, there is always a caveat!

How to check if a business is VAT registered

It is difficult to confirm if a business is VAT registered without their VAT number. Although there are various websites where you can enter a business name and they will give you their VAT number, these are not official government websites and the information may be incomplete or incorrect.

How to check if a company is VAT registered without a VAT number

If you don’t have their VAT number; there is no official way to confirm if a business is VAT registered. A good starting point is to ask your supplier to issue an invoice containing their correct VAT number but there are also several websites that will allow you to enter a company name and it will give you their VAT number, if they have one. If you enter ‘VAT number search’ into your search engine, some of these sites will appear. These sites may show old, de-registered VAT numbers and, if the company is a member of a VAT group, their number may not show up.

Some sites are better than others; some are updated regularly and will include Isle of Man VAT registrations too. It has been known that the VAT number for a new registration will appear on these sites before the business has been informed (this is down to HMRC’s slow mail processing and nothing nefarious!).

Once you have a VAT number from here, you can then check it is correct on the government website.

It is an offence to charge VAT when a business is not VAT registered and, if they’re found to be charging VAT, HMRC can charge them a penalty of up to 100% of the VAT incorrectly charged.

If you are charged VAT by a supplier but they are not VAT registered and any VAT number on their invoice is deregistered or invalid, please remember that if you have paid over the VAT element of an invoice, this is not considered VAT by HMRC so will be disallowed. HMRC are also likely to open an enquiry into your supplier.

It should always be part of any due diligence with a new supplier to confirm their VAT registration number here.

How to check if a company is VAT registered with a VAT number

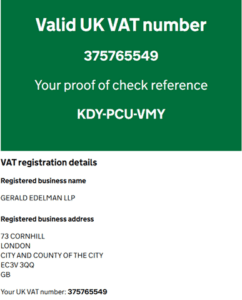

If you have their VAT registration number; it is a simple check to ensure it matches the business you are dealing with click here.

You can enter the VAT number and this will confirm the business name and the address, as per HMRC’s records. If you wish to keep a copy of this check or some reference that you have carried out this task, you can also enter your own VAT number and the site will allocate a reference number to this request.

How to check an EU VAT number

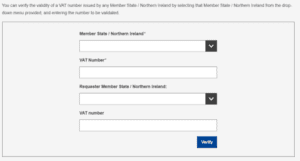

The EU wide site has a system called VIES (VAT Information Exchange System), that allows a business to validate any EU VAT number.

There is a simple website that allows you to check an EU VAT number but, you need another EU VAT number to do so. This is helpful for UK businesses that may be registered in the EU; some EU countries have two levels of VAT number and so they are not automatically entered onto this system, if their number does not show up on the site then they are not registered for intra-EU trading (this will not apply to trading outside the EU).

By clicking on the above link, you enter the country of your supplier in the first box and their VAT number (without the country identifier) in the second. You will need to enter your country in the third box and then your VAT number in the final box. The country codes are in alphabetical order by the VAT number country code (for example Spain is near the top under ES).

If the number is not registered for cross border transactions, you will get the message below.

If you don’t have their VAT number; it can be difficult to independently confirm if a business is VAT registered. In the first instance, you should ask your supplier but there are also several websites that will allow you to enter a company name and it will give you their VAT number, if they have one. As above, if you enter ‘VAT number search’ into your search engine, some of these sites will appear, many of these have the option to search EU companies too.

Why check if another company is VAT registered?

You may wish to confirm that the business you are dealing with is VAT registered for a variety of reasons. If you traded with the EU before 1 January 2021, you may be familiar with the EU wide site where you can check an EU business’s VAT number. While that is no longer an option, you can still check a UK VAT number.

A VAT registered business can only reclaim VAT if they have a proper tax invoice from their supplier, this should include their VAT number; if it doesn’t have a VAT number or the VAT number is invalid then you cannot reclaim any VAT and HMRC will disallow it even if you have paid it over to your supplier. HMRC do not consider VAT incorrectly charged to be VAT so it is helpful if you can confirm that the VAT number is correct.

If you are submitting a VAT return for a VAT repayment, this is more likely to be queried by HMRC than payment returns. Checking VAT numbers on the invoices is a basic check carried out by HMRC so you can pre-empt this by confirming the numbers yourself.

VAT Registration FAQs

What is a VAT registration number?

This is a nine digit number used to identify a VAT registered business.

When is a company required to register for VAT?

Any UK business who’s taxable turnover breaches (or is expected to breach) £90,000 in a rolling 12 months is required to register. Any business not established in the UK or who does not have UK directors must register for VAT when making any taxable supplies in the UK. It can be preferable to register for VAT if your taxable turnover is below the £90,000 threshold if you deal with only other VAT registered businesses. Further information can be found here.

Can I reclaim VAT if the invoice has the wrong VAT number?

No, this is not a valid VAT tax invoice, you should contact your supplier and request a corrected invoice.

Summary

Here’s a summary table showing the different options for checking if a company is VAT registered.

| VAT Number source | I have VAT number | I don’t have VAT number |

| UK | https://www.gov.uk/check-uk-vat-number | Call the company to request their VAT number or web search ‘VAT number search’ |

| EU | https://ec.europa.eu/taxation_customs/vies/#/vat-validation | As above. |

For more specialist VAT advice, please contact us.

Let’s get started

Contact page

Contact Us