How to complete a VAT return

VAT-registered businesses need to submit VAT returns regularly – usually monthly, quarterly or annually. Like most areas of VAT, preparing and submitting a return can be very straightforward… until it isn’t!

The VAT return is a form that will show the VAT you owe HMRC, the VAT you can recover from HMRC, and the value of your sales and purchases for the business covering the period of each return. In this post, we’ll cover everything you need to know about completing a VAT return, including:

- Who has to complete a VAT return?

- Is it easy to complete a VAT return?

- How to complete a VAT return?

- Top tips for completing a VAT return

- FAQs

Who has to complete a VAT return?

Any business that is registered for VAT must complete a VAT return, as required, periodically. This can be a sole trader, partnership, limited company, a VAT group of companies and any overseas businesses registered in the UK for VAT.

Is it easy to complete a VAT return?

Most VAT returns can be easy to complete. It is merely a list of all sales and all purchases where the VAT has been identified separately, totalled and added to the correct boxes on the return form.

Many businesses can complete the return themselves using accounting software, others will ask their agent or bookkeeper to complete and submit the return. Others may ask their accountant to review the return before submission or to check the first few to ensure everything has been set up correctly.

The key to submitting an accurate return is to ensure that both customers and suppliers are set up correctly on any accounting software and most software will calculate the VAT correctly, provided it has been set up correctly.

Businesses involved in any margin scheme (used car dealers, second-hand goods) will have to make manual adjustments for these sales as will any business who needs to carry out partial exemption calculations.

How to complete a VAT return

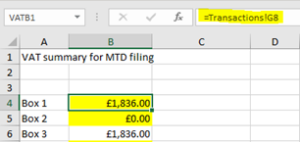

Making Tax Digital (MTD) is how all VAT returns should be submitted (unless you have express written permission from HMRC and this is only given in very limited circumstances). Essentially, HMRC requires there be a link from the total in each of the boxes on the VAT return to the source data.

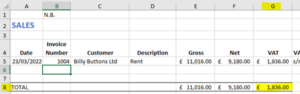

In the simple example below, you can see that the total VAT due in box one of the VAT return has a ‘link’ to the sales list.

A VAT return must be submitted using MTD-compatible software. Most accounting software can be used for submitting MTD returns or, bridging software can be used to submit a return using an Excel spreadsheet.

The main accounting software systems, Xero, Quickbooks and Sage, will walk you through preparing and submitting the VAT return, provided they have been set up correctly. These systems also allow you to upload invoices so you are no longer rummaging through drawers, files and cupboards to find the relevant invoices.

You can also link the above to your government gateway and, once you’re happy with your VAT return, submit it directly to HMRC by the click of a button.

If your business is small or has few transactions, you may not want to invest in accounting software but use a simple Excel spreadsheet. This can be submitted, via your government gateway, with the correct bridging software. This bridging software should take you through the steps to ensure everything is carried across to HMRC.

Preparing to complete the VAT return

What you need:

- Copies of any sales invoices issued.

- Purchase invoices.

- Bank statements.

- Cup of tea!

You should enter all sales and purchase invoices onto your accounting software or Excel sheet.

If using a spreadsheet, there can be many ways of recording the information but, it’s always best to use the KISS principle but column headings should, as a minimum, be:

- Date.

- Invoice number.

- Customer/supplier.

- Net Amount.

- VAT Amount.

- Rate of VAT.

Useful additions can be:

- Payment made/received.

- Description of goods/services made/received.

It is important that when setting up your software that you have entered the following:

- Business name

- Address

- VAT number

- Any schemes used

This is to ensure that HMRC can put the return to your account and no one else’s.

Once you have listed and totalled all the sales and purchase separately, you are ready to enter all the details into the VAT return form.

Completing the VAT return

Box one – VAT due in the period on sales and other outputs

- VAT due on all sales in the period.

- VAT due under reverse charge accounting, including any PVA statements.

- Fuel scale charge (if input tax is recovered on road fuel for any cars).

- The sale of stocks and assets.

- Goods you take out of the business for your own private use.

- Commission received for selling something on behalf of someone else.

Box two – VAT due in the period on acquisitions of goods made in Northern Ireland from EU member states

For most UK businesses this will be ‘nil.

Box three – Total VAT due

This is the total VAT due, that is, boxes one and two added together. This is your ‘output VAT’ for the period.

Box four – VAT reclaimed in the period on purchases and other inputs

This is the total VAT on your purchase, your ‘input tax’, including any import VAT.

You can reclaim VAT if you:

- Have paid under the reverse charge procedure.

- Pay on imports (as long as you’ve got the relevant import VAT certificate).

- Are claiming back as bad debt relief.

- Make acquisitions of goods into Northern Ireland from EU member states (this must correspond with the amount declared within box two).

Make sure you do not include VAT:

- You pay on goods bought wholly for your personal use.

- On business entertainment expenses.

- On second-hand goods that you’ve bought under one of the VAT second-hand schemes.

Remember to deduct VAT on any credit notes issued to you.

Box five- Net VAT to pay to HMRC or reclaim

This is the difference between boxes three and four – it is what you owe or are owed by HMRC.

Box six – Total value of sales and all other outputs excluding any VAT

This is the total value of all your business sales and other outputs, net of any VAT.

This includes:

- Zero-rated, reduced rate and exempt supplies.

- Fuel scale charges.

- Exports.

- Supplies to EU member states, if the goods are moved from Northern Ireland (that is any figure entered in box eight).

- Distance sales to Northern Ireland which are above the distance selling threshold or, if below the threshold the overseas supplier opts to register for VAT in the UK.

- Reverse charge transactions.

- Supplies which are outside the scope of UK VAT.

- Deposits that an invoice has been issued for.

But, you do not include in box six any of the following:

- Money you’ve personally put into the business.

- Loans, dividends and gifts of money.

- Insurance claims.

- Stock Exchange dealings (unless you’re a financial institution).

Box seven – The total value of purchases and all other inputs excluding any VAT

Show the total value of your purchases and expenses, excluding VAT:

- Import.

- Acquisitions of goods you bring into Northern Ireland from EU member states (that is any figure entered in box nine).

- ‘Reverse charge’ transactions.

Do not include the following:

- Wages and salaries.

- PAYE and National Insurance contributions.

- Money taken out of the business by you.

- Loans, dividends, and gifts of money.

- Insurance claims.

- Stock Exchange dealings (unless you’re a financial institution).

- Local authority rates.

- Expenditure that’s outside the scope of VAT because it is not consideration for a supply.

Boxes eight and nine are only relevant if you have sold or received goods form the EU and you are based in Northern Ireland.

Top tips for completing a VAT return

- Don’t leave it to the last minute.

- Make sure you retain all purchase invoices, especially those for daily expenses – don’t be afraid to ask for a tax invoice, a payment receipt does not usually have enough information to classify as a proper tax invoice.

- If you don’t have a purchase invoice, don’t claim it!

- If the invoice isn’t made out to the business, don’t claim it.

- If you think you may have trouble paying the full amount due, contact HMRC as soon as possible so they can help you.

- Check all your sales invoices have the VAT calculated correctly and, if there is no VAT charged, confirm this is correct.

- If in doubt, ask your adviser.

FAQs

How often do I have to do a VAT return?

Monthly: This is usually for businesses that receive regular VAT repayments

Quarterly: Everyone one else!

Annually: Only available to those businesses with an annual turnover less than £1.35M

How long do I have to submit a VAT return?

The due date is clearly noted on your government gateways and, for monthly and quarterly returns, is five weeks after the period ends or the 7th of the following month after the period end. If the VAT return period is January – March and the period end is 31 March, the return must be submitted and paid by 7 May (if this falls on a weekend or Bank Holiday, it will be earliest working day before this date).

What happens after submitting a VAT Return?

It will appear very quickly afterwards on your government gateway account. If you submit it before the due date, payment does not need to be made until the due date.

How long do I have to pay a VAT return?

If you pay by direct debit, you must have sufficient funds in your account on the due date even though it may be shown as leaving your account until a few days later.

Some businesses may be put onto payments on account if they make VAT payments to HMRC in a 12 month period of £2.3 million, this means they will have to make a monthly payment (as per the HMRC mandate) with the balancing figure due the month following the third month of the VAT return.

What if I made a mistake on my return?

Any business can make an error correction if they find an error on a return they have already submitted, this should be done using the online form.

If the value is less than £10,000 (or under £50,000 and less than 1% of the outputs for this return) they can adjust it on the next return.

What if I’m using a special VAT scheme, like the flat rate scheme?

If you use the flat rate scheme, your VAT return will be simpler but no input tax can be recovered unless it is the purchase of a business asset over £2,000.

You establish your flat rate % and multiply your gross sales by this amount to calculate your output tax this is your box one figure and the rest is your box six figure.

Let’s get started

Contact page

Contact Us