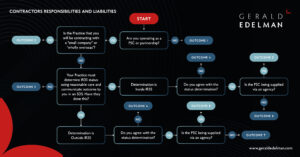

IR35 flowchart for Contractors

In this article, we share details on the different outcomes in our IR35 flowchart for Contractors. Based on your circumstances as a Contractor, we include the next steps to take and where any liability falls. See the full flowchart and actions below:

Outcome 1:

Action: Off-payroll rules do not apply to you.

Liability: None. (Under off-payroll rules – other legislation applies to umbrella/PAYE workers).

Outcome 2:

Action: If your client is a ‘small company’ or ‘wholly overseas’, the original IR35 rules (chapter 8) apply – Contractor/PSC decides own IR35 status and any liabilities, for unpaid taxes sits with the Person with Significant Control (PSC).

Liability: PSC – your PSC will be liable for an incorrect assessment.

Outcome 3:

Action: None.

Liability: Client. The client is liable for any unpaid taxes and National Insurance (NI) until it provides a valid Status Determination Statement (SDS). Once a valid SDS has been issued, you should re-consider actions and outcomes using this flowchart.

Outcome 4:

Following 6 April 2021, legislation now supports a formal disagreement process. The client is under obligation to implement this disagreement process. They must consider the basis of your written disagreement and respond within 45 days either re-affirming the decision along with reasons, or issue a new SDS, again giving reasons. If the client fails to respond within 45 days it assumes the liability of an incorrect assessment, until it responds formally. Once a decision has been issued, you should re-consider actions and outcomes using this flowchart.

Outcome 5:

Action: Agency ensures payments are PAYE compliant.

Liability: Agency (no unpaid taxes; no liabilities). Since all taxes and NI will have been paid, there are no liabilities under the off-payroll rules. The agency is liable if it makes any mistakes in payments/deductions.

Outcome 6:

Action: Client must ensure payments are PAYE compliant. The client must make appropriate deductions for income tax and Employee’s NI before paying your PSC. The client must also pay Employer’s NI and report all payments via Real Time Information (RTI). Worker’s payments will be subject to Apprenticeship Levy (if applicable). Alternatively, the client can require you to move to another payment model (e.g compliant PAYE umbrella or direct PAYE) or to an agency supply chain (agency then holds liability for payments).

Liability: Client – (no unpaid taxes; no liabilities). Since all taxes and NI will have been paid, there are no liabilities under the off-payroll rules. If the client makes a mistake in payments/deductions, the client will be liable.

Outcome 7:

Action: Your client will pay your PSC without deductions (i.e outside IR35).

Liability: Client (as fee-payer). If there is no agency in the supply chain then the client is the fee-payer and liable for any unpaid taxes and NI.

Outcome 8:

Action: Your agency will pay your PSC without deductions (i.e outside IR35).

Liability: Agency (as fee-payer). If the client has given the determination to the agency and the worker before the deadline and taken reasonable care, they will not be liable, even if the determination is held by HMRC to be wrong. If the determination is wrong, but reasonable care has been taken, the agency holds all liabilities.

For further guidance on any of the above outcomes, contact Rhys Thomas today at rhys.thomas@wttconsulting.co.uk.

Let’s get started

Contact page

Contact Us